General Purpose Cards

For most people who want to venture into earning credit card points or cash back, this is where they start. General purpose cards such as the American Express Blue Cash Everyday Credit Card or the Chase Freedom Unlimited, are great for the consumers who don’t want to carry multiple cards and have a wide variety of spending. The American Express Blue Cash Everyday Credit Card lives up to its name by offering 3% cash back at US Supermarkets(up to $6,000 a year), 3% cash back at gas stations, 3% cash back on online retail and 1% Cash back on all other spend.

The Chase Freedom Unlimited is another great option and one of the cards currently in my wallet. The Chase Freedom Unlimited offers 5% cash back on travel purchased through Chase Ultimate Rewards, 3% cash back on dining and takeout/delivery services, and 1.5% cash back on all other purchases. Although cash back cards aren’t my favorite in terms of value, they are great intro cards for someone looking to start their journey.

Best Travel Cards

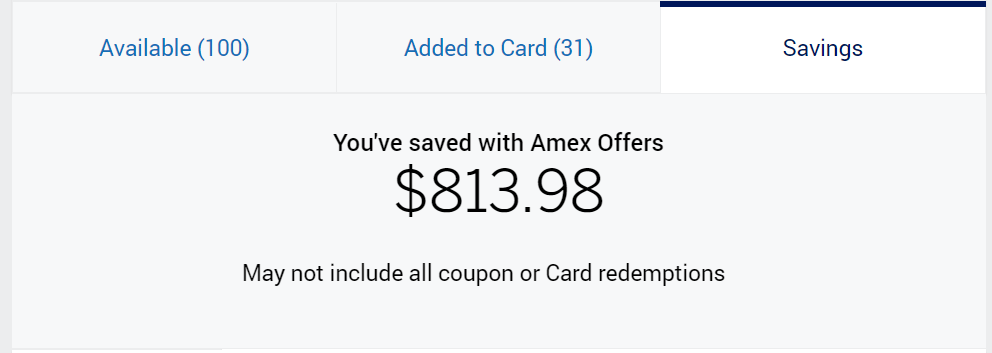

The best travel credit cards are often considered “top tier cards” because they come with pretty high fees, however these fees can easily be offset and allow you earn more value than they cost. My favorite travel cards are the American Express Platinum and the Chase Sapphire Reserve, each carrying a hefty annual fee($695 for Amex Platinum and $550 for the Chase Sapphire Reserve). The American Express Platinum is my personal favorite, currently offering up to 125K Membership Reward points with benefits like 5X points on all travel booked through amextravel.com or the airline directly, a $200 airline credit, access to the Delta SkyClub, access to the American Express Centurion Lounges, Hilton Honors Gold status, Marriott Bonvoy Gold Elite status, National Rental Car Executive status, $100 a year to Saks Fifth Avenue, and a $120 Uber/Uber Eats Credit, this card will always be in my wallet! So far this year, I have saved over $800 from Amex offers on top of all of my other benefits!

I’ll be posting later about some of the crazy deals I have received including my 28″ Blackstone Griddle that I purchased for a net $50!

My second favorite travel card is the Chase Sapphire Reserve. Although I personally live more in the Amex Rewards system, I have several friends who swear by the CSR(Chase Sapphire Reserve). The Chase Sapphire Reserve offers a $300 annual travel credit that can be used on anything that codes as travel(cruises, flights, hotels, etc.) along with 3x points on travel and dining. Chase Ultimate Reward points are very similar to American Express Membership Rewards points and are widely considered worth 2 cents per point. When combined with the Chase Unlimited Freedom, you are able to turn your cash back percentages into points and complete the Chase Duo(Chase Unlimited Freedom + Chase Sapphire Reserve) unlocking even more potential to book free trips because your points are worth 50% more in the Chase Ultimate Rewards portal.

Best Cards for Dining

Dining credit cards typically come in two categories; cash back dining rewards and points dining rewards. I personally will always choose a points card over a cash back card, because the value can be 2X or greater if used correctly, however I will give you my top pick for both categories.

The best cash back dining card is the Capital One Savor Rewards card, offering 4% cash back on dining and entertainment, 2% cash back at grocery stores, and 1% cash back on everything else for a modest $95 annual fee. Although this is promoted as a dining rewards card, it is nice that they still provide you with some multipliers for other categories and not just a flat 1% across the board. The reason I prefer points cards is fairly simple, 4% cash back is essentially 4 cents per point, while 4X American Express Membership Rewards points is 8 cents per point with each Membership Rewards point being worth 2 cents per point(4X points x 2cpp = 8 cents per point).

My favorite points dining rewards is hands down the American Express Gold Card, which is currently offering up to a 90,000 Membership Rewards point bonus when you use the referral link above(worth $1800)! This card is another keeper card of mine that offers 4X Membership Rewards points at restaurants and grocery stores, 3X points on travel, and 1x point on everything else. Although the American Express Gold Card has a $250 annual fee, the average American household will earn enough points from grocery stores alone to cover the annual fee for several years. Combine the modifiers above with the $120 Uber Eats credit annually and you have the card that I pull out of my wallet the most!

Keep in mind that your American Express Membership Reward points are pooled across cards and can be used on anything from Amazon to booking that YOLO trip to the Maldives!