I don’t know if anyone has priced a trip to Vegas recently but let me tell you… It certainly is not cheap! We traveled to Vegas for a wedding last month and when pricing out first class airfare + the Cosmopolitan for 2 nights… it was over $10,000! Luckily for us, I had enough points to cover the entire trip, thanks to my American Express Platinum and American Express Gold cards. Let’s look at both the flights, the room, and how I earned enough points to cover this entire trip.

Airfare – Delta Domestic First Class

If you didn’t already know, I am a bit of a Delta snob. I will gladly take connecting flights in order to fly Delta over any other airline and it has rewarded me with Platinum Medallion status that often gets me upgraded to First Class seats. This was not a chance I wanted to take and therefore forked out 335K SkyMiles to reserve my first class tickets. Due to many factors, airline tickets are at an extremely high price and were $7,880 for two first class tickets on Delta… That is a lot of money when I easily had the points to cover it.

Delta SkyMiles are generally considered to be worth about 1.5 cents per point, however I was able to earn 2.3 cents per point. Anything over 1.5 cents per point is considered a good use of points, and therefore made my decision easy. To calculate cents per point, simply divide the cost of the tickets($7,880) by the amount of points it would take to book the flights(335,000) and multiply by 100… 7,880/335,000 x 100 = 2.3cpp.

Along with free alcoholic beverages, more space, and priority boarding, Delta domestic first class has certainly stepped up their dining game! With a 6AM flight from Las Vegas back to the east coast, eating before you board can be rather difficult; however, with an asparagus and sundried tomato quiche… Delta didn’t disappoint.

Hotel – The Cosmopolitan

With the recommendation from the groom, we decided to stay at the Cosmopolitan, which certainly didn’t disappoint. The room had a great view overlooking the Bellagio fountains along with being clean, quiet, and centrally located to everything. We booked a Terrace Suite, Guest room, 1 King, Fountain view, which was either $900 a night + $45 a day resort fees or 240,000 points for the entire stay. I certainly didn’t feel like spending over $3100 and went the points option, earning me a 1.29 cents per point when Marriott points are traditionally valued at .07 cpp. We were upgraded to a central location room due to my Marriott Gold status via my American Express Platinum; which is an often underutilized perk of the card.

Earning Points

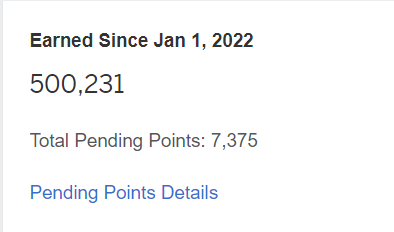

Since January 1st of this year, I have earned 500,231 points as seen in the screenshot below. These points were earned on both my American Express Gold card and my American Express Platinum card on almost a 50/50 split. I often save my points for trips like this, as opposed to using them for purchases. Using points to pay for purchases is one of the worst possible valuations and therefore should be avoided if you have the ability.

I typically divide my purchases into a few categories: Grocery stores/Dining, purchases I want purchase protection/warranty on, travel, and everything else.

For grocery stores/dining, I always use my American Express Gold card to earn 4x points per dollar. Assuming American Express Membership Reward points are worth 2 cents per point, you are earning 8 cents per point on every dollar you spend. This is one of the best valuations for what the majority of folks spend their money on.

For purchases that I want purchase protection and extended warranty on, it is a no brainer to use the American Express Platinum card. The American Express Platinum offer return protection, purchase protection, and extended warranty protection, all of which have been painless for me to use. Each of them have their own caveats; however, I have not had an issue with any of my claims getting reimbursed and the process is painless.

Travel, especially airfare booked directly with the airlines, should always be booked using the American Express Platinum. When booking airfare from either amextravel.com or directly through your airline, you earn 5X points per dollar spent, essentially earning you 10 cents per point. I have found some great deals on amextravel.com as compared to direct pricing from the airlines; however, I normally book directly as it is much easier to change flights this way.

All other purchases that don’t fall into the above categories I will use either my American Express Gold or American Express Platinum, depending on which card has offers loaded on it. For example, I recently had an offer on my American Express Gold card, for an additional 12,500 points for every $4,000 spent. I therefore used my American Express Gold card until I hit the bonus offer.

Although this trip set me back almost 600K points, it was certainly worth it compared to the $10,000 out of pocket cost.

What is your greatest savings using points? Do you have any trips coming up you could use points on to save money? Drop a comment below!

One thought on “How I saved $10K on a trip to Vegas!”